Bearish scenario: Sell below 2200 / 2194 ... Nearest bullish scenario: Buy above 2197... Bullish scenario after retracement: Consider buys around each indicated demand zone

2024-01-29 • Updated

Gold prices experienced a brief uptick due to escalating geopolitical tensions. Recent conflicts, such as the drone attack on US bases near Jordan, have increased demand for gold as a haven asset. Additionally, economic factors like the moderate increase in US Core Personal Consumption Expenditures (PCE) data have influenced inflation expectations, further supporting gold's position. This week, gold market volatility could escalate with the Federal Reserve's interest rate decision, expected to remain steady in the 5.25-5.50% range. However, investors will watch for any new guidance on interest rates, which could influence gold's future direction. Additionally, the ISM Manufacturing PMI and Nonfarm Payrolls (NFP) report for December could also play a significant role in determining gold's short-term trajectory.

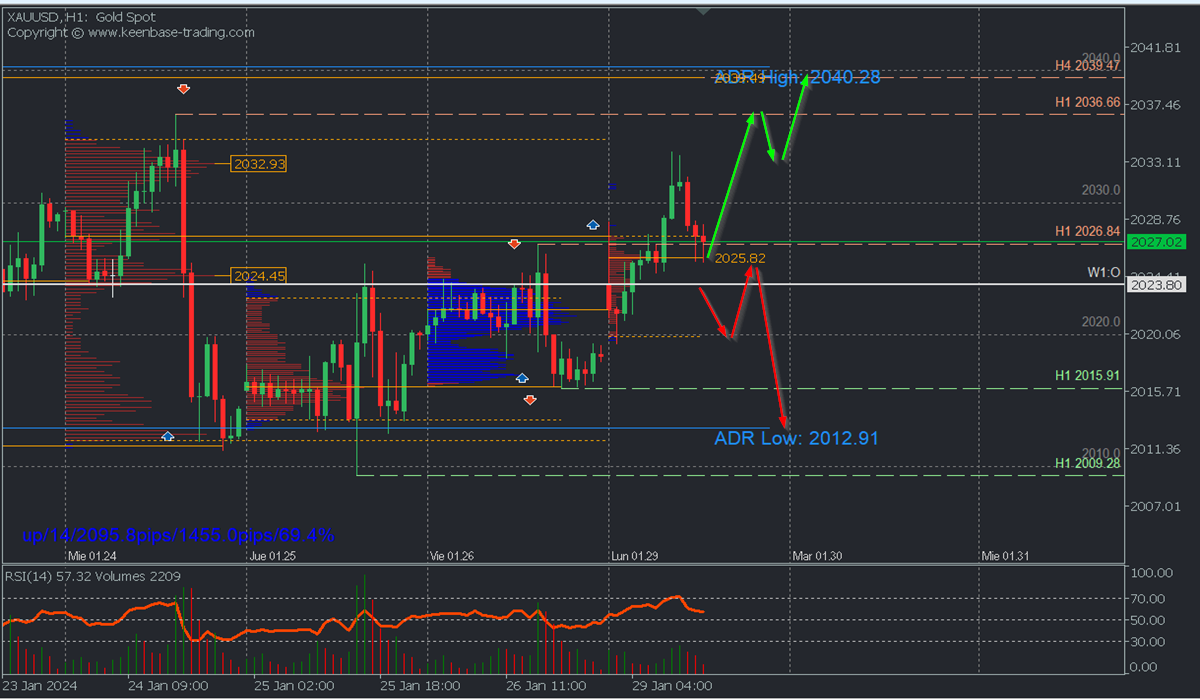

After a week of consolidation, a high-volume node formation around 2028 suggests a distribution process may be preparing for a new decline towards 2000 and 1980 in the short term, with a potential break below December support at 1973.10, implying a reversal of the current bullish trend. On the other hand, a decisive breakthrough of January's volume concentration around 2028 leaves open the possibility of a recovery towards 2050 and 2060.

RSI below 50 and declining vertical volume after the last three days of ascent, suggest a bearish scenario in the short term. It's always important to remember that any surprising event, altering geopolitics and market risk sentiment can change technical outlooks in just one day, depending on circumstances.

The pair is still retracing upwards within the bearish expansion range from Wednesday, January 24, reacting to the high volume node around 2033 and respecting resistance at 2036.66. This rise extends after the Asian opening, leaving a point of control (POC) at 2025.82, a buy zone expected to be defended by bulls in the coming hours, with a rally towards resistances at 2036.66 and 2040 only if it manages to surpass today's Asian/European peak at 2033.87.

On the other hand, a tepid bullish reaction and a strong breakout of the early sessions' POC at 2025.82 will lead to a decline towards the week's opening and the round level 2000, confirming the coverage of the opening gap and challenging the last relevant support at 2015.91, whose confirmed breakout with a second lower low will signal a bearish reversal for the yellow metal.

*Uncovered POC: POC = Point of Control: It is the level or zone where the highest volume concentration occurred. If there was previously a bearish move from it, it is considered a sell zone and forms a resistance area. On the contrary, if there was previously a bullish impulse, it is considered a buy zone, usually located at lows, thus forming support zones.

**Consider this risk management suggestion**Risk management should be based on capital and trading volume. A maximum risk of 1% of the capital is recommended. Risk management indicators like Easy Order are suggested.

Disclaimer

—-----------------------------------------------------

This document does not constitute a recommendation to buy or sell financial products and should not be considered as a solicitation or offer to engage in transactions. This document is the author's economic research and does not intend to provide investment advice or solicit securities or other investment transactions at FBS. While all investment carries some degree of risk, the risk of loss in trading currencies and other leveraged assets can be considerable. Therefore, if you are considering trading in this market, you should be aware of the risks associated with this product to make informed decisions before investing. The material presented here should not be construed as advice or trading strategy. All prices mentioned in this report are for informational purposes only.

Bearish scenario: Sell below 2200 / 2194 ... Nearest bullish scenario: Buy above 2197... Bullish scenario after retracement: Consider buys around each indicated demand zone

Bullish scenario: Intraday buys above 2160.00 with TP: 2171 and TP2: 2177 // Bearish scenario: Sells below 2177 with TP1: 2150, TP2: 2142, and 2126

This article uses price action and volume profile techniques to address a fundamental and technical perspective based on the daily chart analysis of spot gold (XAUUSD).

Jerome H. Powell, the Federal Reserve chair, stated that the central bank can afford to be patient in deciding when to cut interest rates, citing easing inflation and stable economic growth. Powell emphasized the Fed's independence from political influences, particularly relevant as the election season nears. The Fed had raised interest rates to 5.3 ...

Hello again my friends, it’s time for another episode of “What to Trade,” this time, for the month of April. As usual, I present to you some of my most anticipated trade ideas for the month of April, according to my technical analysis style. I therefore encourage you to do your due diligence, as always, and manage your risks appropriately.

Bearish scenario: Sell below 1.0820 / 1.0841... Bullish scenario: Buy above 1.0827...

FBS maintains a record of your data to run this website. By pressing the “Accept” button, you agree to our Privacy policy.

Your request is accepted.

A manager will call you shortly.

Next callback request for this phone number

will be available in

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later

Don’t waste your time – keep track of how NFP affects the US dollar and profit!